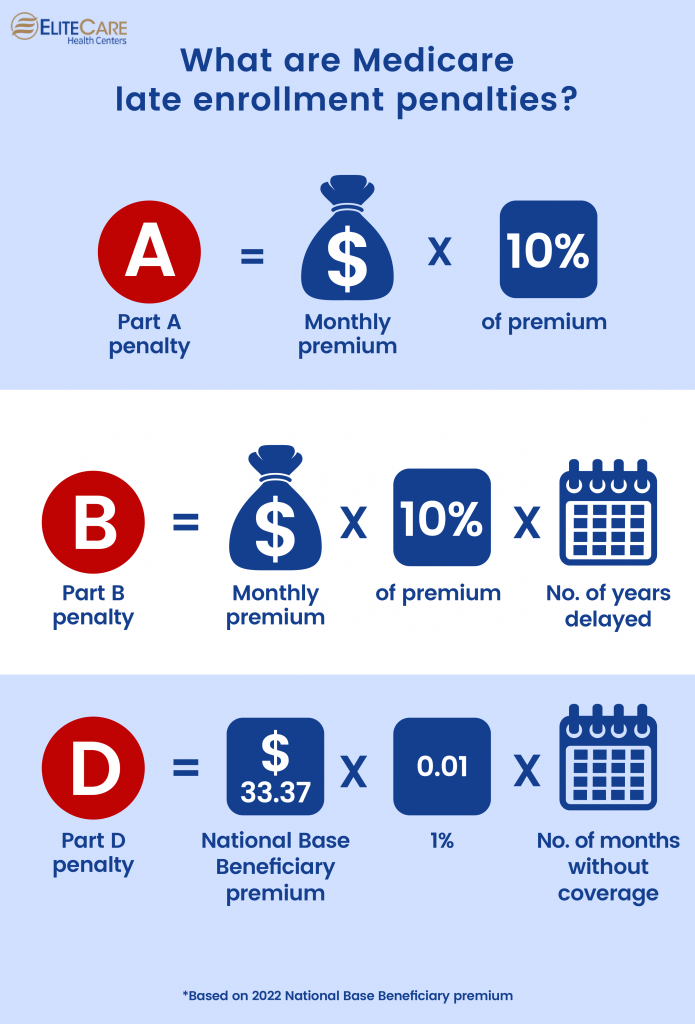

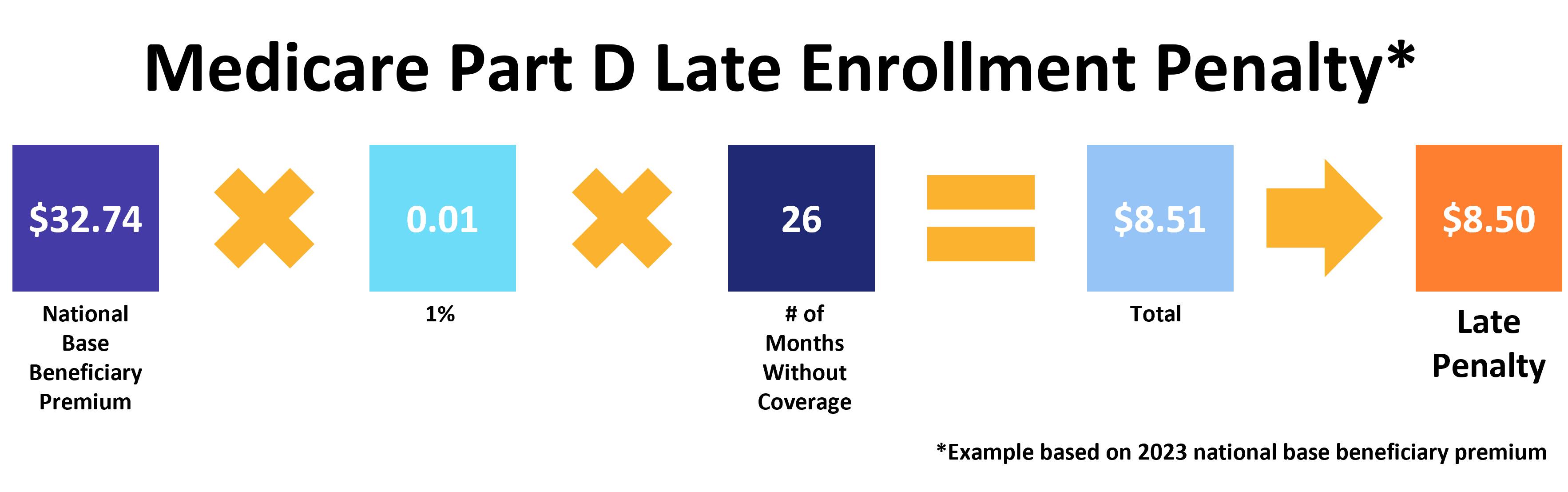

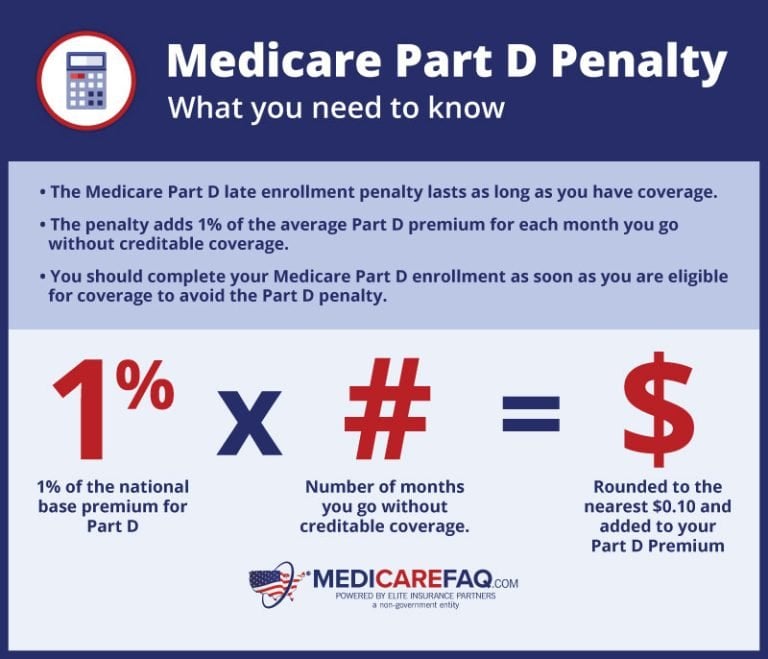

Medicare Part D Late Enrollment Penalty 2025. Medicare calculates your late enrollment penalty by multiplying the number of full months you were without some form of creditable prescription drug coverage by 1% of the. Medicare late enrollment penalty for part d.

The medicare part d late enrollment penalty is a financial consequence imposed on individuals who delay their enrollment in the program without having creditable drug. The late enrollment penalty is calculated as an additional 1% of the average annual base medicare part d premium (for example, $36.78 in 2025 up from $34.70 in 2025).

Medicare Part D Late Enrollment Penalty YouTube, The part d penalty is 1% of the national base beneficiary premium each year, multiplied by the number of full months you did not have part d or creditable coverage.

Best Rated Medicare Part D Plans for 2025, The medicare part d late enrollment penalty is an additional cost on top of your monthly medicare part d premium.

Medicare Part D Penalty Calculator 2025 Dusty Glynnis, What is the medicare part d late enrollment penalty?

A Complete Guide to Avoid Medicare Late Enrollment Penalties EliteCare, The part d penalty is 1% of the national base beneficiary premium each year, multiplied by the number of full months you did not have part d or creditable coverage.

How To Avoid The Medicare Part D Late Enrollment Penalty YouTube, The national base beneficiary premium.

Medicare Part D Penalty ClearMatch Medicare, On december 10, 2025, the centers for medicare and medicaid services (cms) released a proposed rule for revisions to the regulations governing the medicare advantage (ma).

Medicare Part D Penalty Calculator 2025 Dusty Glynnis, Medicare calculates your late enrollment penalty by multiplying the number of full months you were without some form of creditable prescription drug coverage by 1% of the.

Medicare Part D Enrollment When to Sign Up for Drug Coverage, For each month you delay enrollment in medicare part d, you will have to pay a 1% part d late enrollment penalty (lep), unless you:

How to calculate Medicare Part D late enrollment penalty? YouTube, If you don’t sign up for part d on time, you’ll pay a penalty of 1% for each month you.

Medicare Late Enrollment Penalties HENRY KOTULA, For each month you delay enrollment in medicare part d, you will have to pay a 1% part d late enrollment penalty (lep), unless you:

Proudly powered by WordPress | Theme: Appointment Blue by Webriti